The inventory module is essential for managing and optimizing stock levels, product management, and reporting. It automates tracking, reduces errors, and provides real-time data on inventory, making it easier to prevent stockouts and overstocking. With its organized product management and insightful reports, the module simplifies inventory control and supports efficient decision-making, making it both useful and user-friendly.

Setup Page: Configure essential inventory settings such as Unit of Measurement, product tags, barcode setup, locations, price lists, and more.

Product Page: Add and manage your products, link it to categories, set brands, and add manufacturers.

Operations Page: Create documents like opening balance, delivery order, Goods Receipt Note (GRN), delivery note, internal transfers, adjustments, and more.

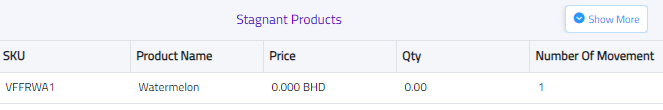

Reports Page: Access various reports including most active products, stagnant products, product aging, product history, and many others

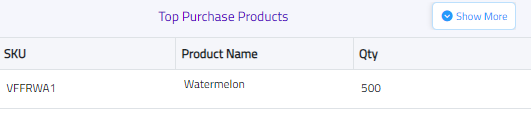

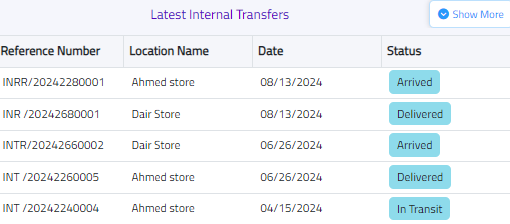

Inventory Dashboard

in the dashboard, you’ll find an overview of the company’s:

- Top purchase orders, latest internal transfer, stagnant products and more.

If you need more details, simply click on the “Show More” button, which will take you directly to the full reports.